cap and trade system vs carbon tax

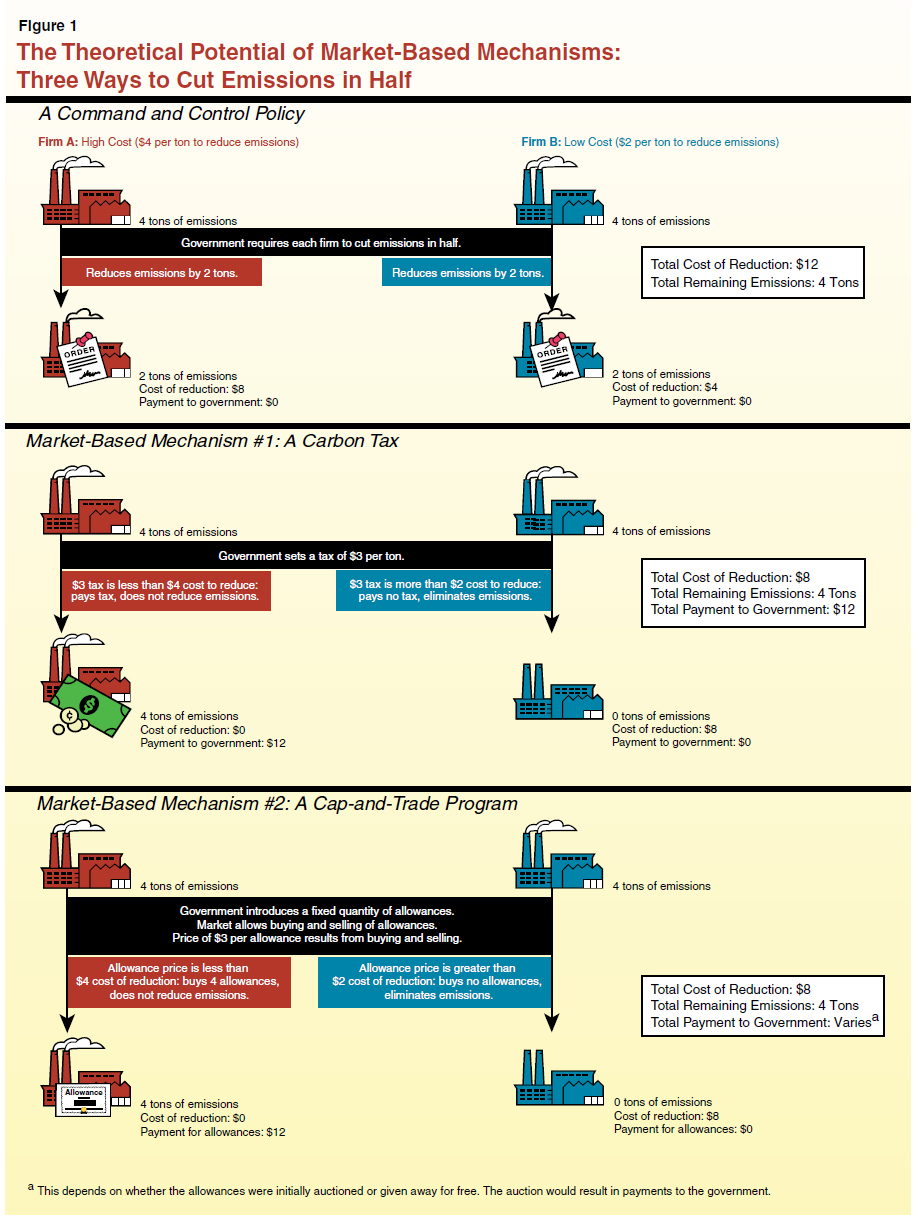

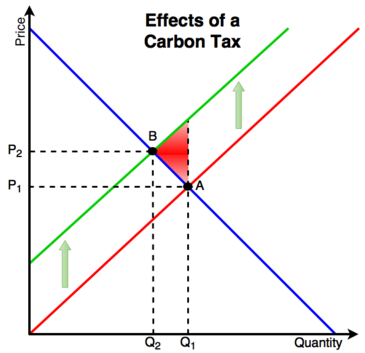

Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate. While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of emissions allowed which can then be used to estimate the decline in the rise of global temperatures.

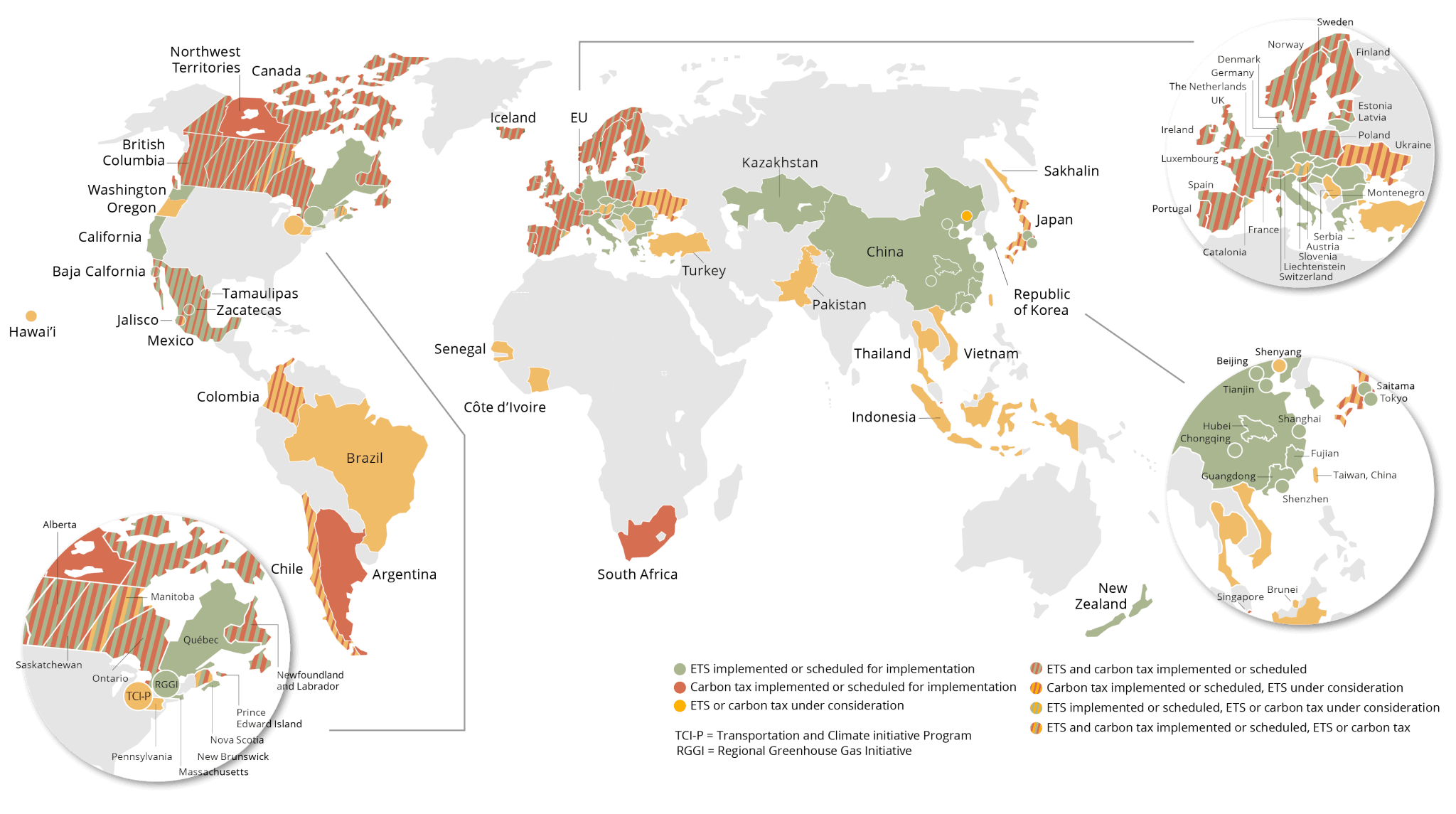

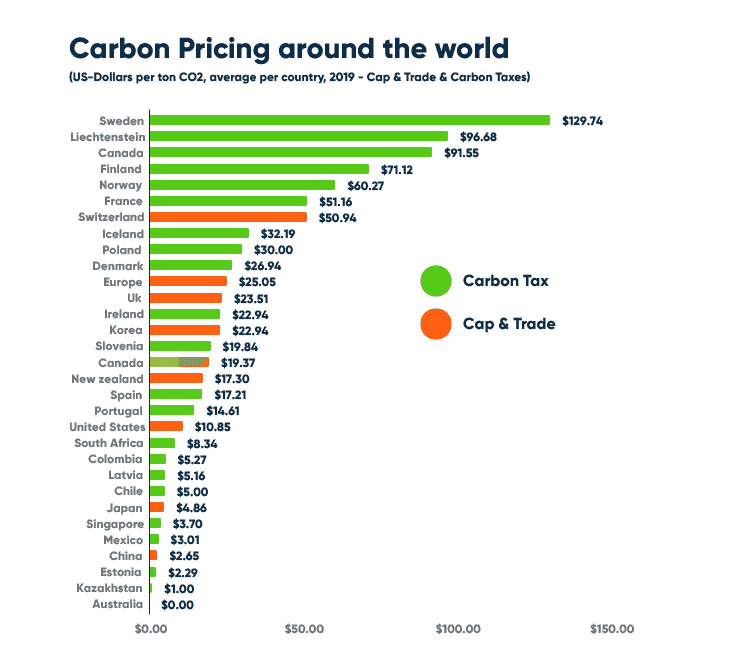

The World Urgently Needs To Expand Its Use Of Carbon Prices Carbon Greenhouse Gases Paris Agreement

Carbon Tax vs.

. Both can be weakened. Each approach has its vocal supporters. Reducing environmental achievement and driving up costs.

2 Explain how a carbon tax could in theory correct for this market failure. The cap aspect is where a government sets an emission cap and issues a. Carbon Tax vs.

To a first approximation cap-and trade is the equivalent of a carbon tax. Peter MacdiarmidGetty Images G r. You can tweak a tax to shift the balance.

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. Reduce carbon emissions and to control pollution since unfortunately the majority of individuals mainly act to their own self-interest and are not concerned with the future of the planet. Carbon taxes and cap-and-trade programs share several major advantages over alternative policies.

Cap-and-Tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and other industries would have to purchase in order to burn fossil fuels whereas a Carbon Taxthe approach most popular among economistswould discourage emissions reductions by. Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels. Cap and Trade.

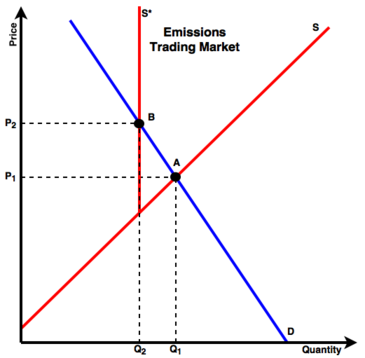

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. The cap typically decreases each year to cut down the total.

Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. We show that the various options are equivalent along. Both reduce emissions by encouraging the lowest-cost emissions reductions and they do so without anyone needing to know beforehand when and where these emissions reductions will occur.

In contrast cap and trade levies an implicit tax on carbon. A carbon tax is an explicit tax and Americans are notoriously tax phobic. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor.

Carbon taxes makes emitting carbon dioxide more expensive. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is. With a cap you get the inverse.

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. Carbon taxes vs. Show in your graph the price consumers face the price producers face and.

In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden. Issue Date August 2013. Essay on Carbon Tax vs.

Theory and practice Robert N. The regulatory authority stipulates the. Proponents of carbon taxes worry about the propensity of political processes under a cap-and-trade system to compensate sectors through free allowance allocations but a carbon tax is sensitive to the same political pressures and may be expected to succumb in ways that are ultimately more harmful.

We show that the various options are equivalent along more dimensions than often are recognized. Before the policy the intersection of the supply and demand curves for. Stavins Harvard Kennedy School abstract There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential.

In contrast under a pure cap-and-trade system the price of carbon or CO 2 emissions is established indirectly. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Under a cap-and-trade system governments impose a strict quota or cap on the overall level of carbon pollution that can be generated.

Cap and Trade 1290 Words 6 Pages. As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. Economic guru and former Federal Reserve Chairman Alan Greenspan has come out against cap and trade as an effective mechanism for reducing carbon emissions.

A carbon tax and cap-and-trade are opposite sides of the same coin. With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own. You can do the same to cap-and-trade.

No matter how much gets emitted a carbon tax makes the emission the same. Carbon Tax vs Cap and Trade 1 Create standard supply and demand curves to illustrate the negative externality that comes with using gasoline. With a tax you get certainty about prices but uncertainty about emission reductions.

April 9 2007 413 pm ET. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. November 2019 Paper There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential element of any national policy that can achieve meaningful reductions of CO2 emissions costeffectively in the United States and many other countries.

I have grave doubts that international agreements imposing a globalized so-called cap-and-trade system on CO2 emissions will prove feasible he wrote in his recent book The Age of. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. Here is the Econ 101 version of how the two work.

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Archive World Bank Group President Jim Yong Kim On Twitter Cap And Trade Climate Reality Sustainability News

Comparison Of Carbon Tax And Cap Trade Eme 803 Applied Energy Policy

Cap And Trade An Overview Sciencedirect Topics

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

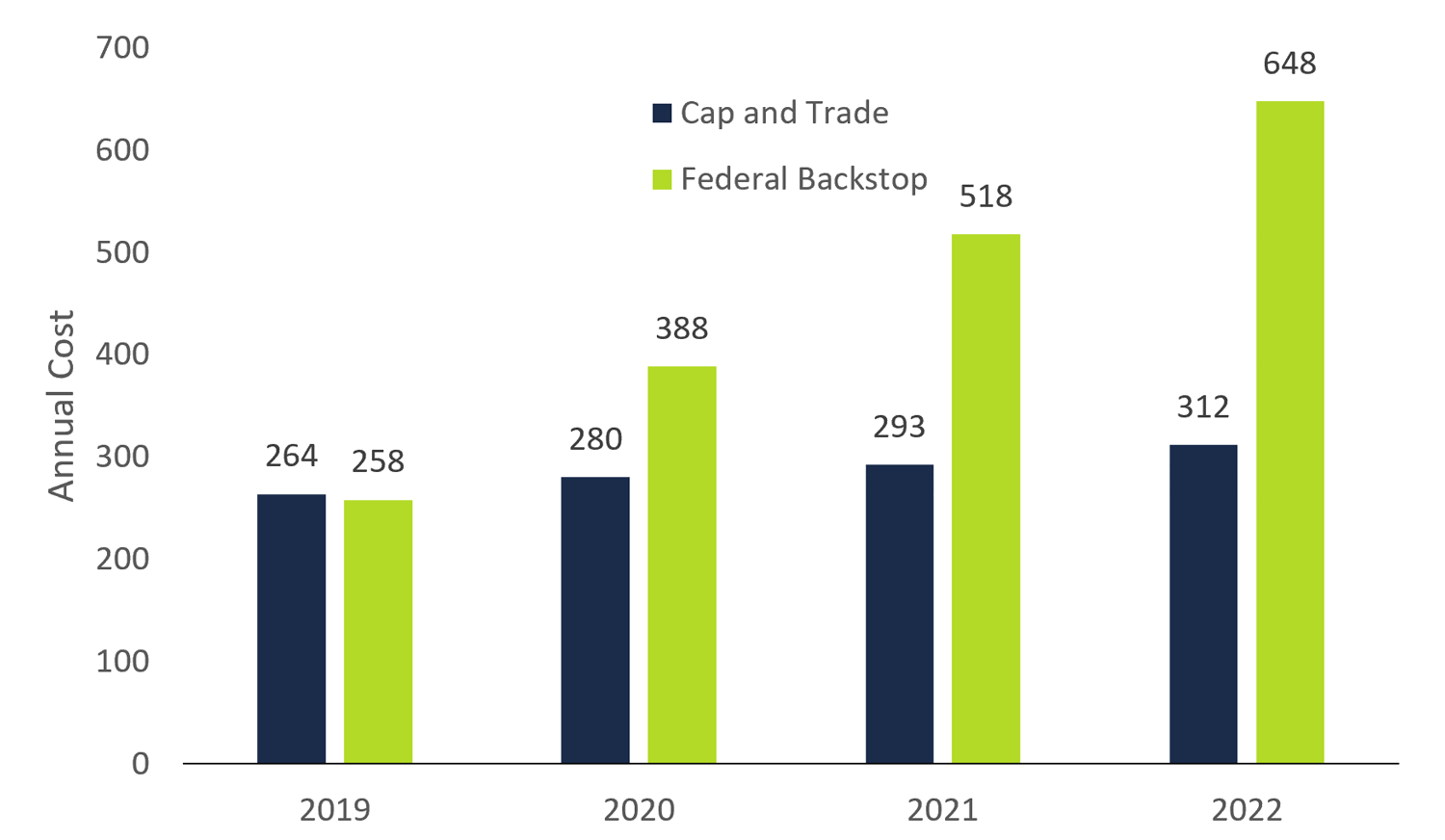

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax And Cap And Trade Youtube

Cap And Trade Basics Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Carbon Tax Versus Cap And Trade

Carbon Border Taxes Are Defensible But Bring Great Risks The Economist

Carbon Markets Putting A Price On Carbon Green City Times

Carbon Tax Vs Emissions Trading Energy Education

How To Design Carbon Taxes The Economist

Carbon Tax Vs Emissions Trading Energy Education

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between